About Vita Sana

Payment & Finance

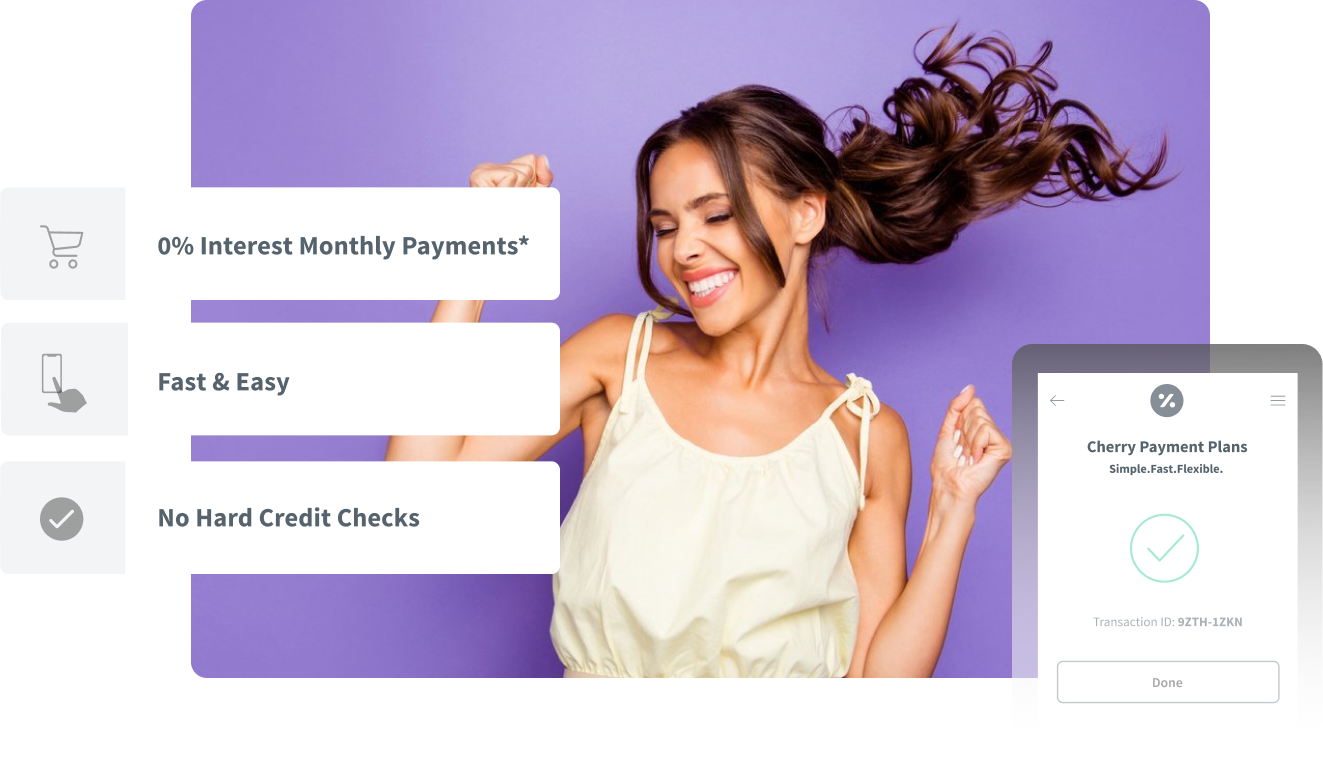

Simple. Fast. Flexible.

With Cherry, fast and easy payment plans for purchases between $200 - $25,000.

Advance Care

Advance Care Card the quickest and easiest way to pay for procedures and treatments not covered by your insurance.

- Process is simple and offers quick decisions.

- Co-signers may be used to increase chances of approval.

- Schedule your medical procedure as soon as you are approved.

- 6 or 14 months interest free financing and competitive interest rates.

- Maximum flexibility

- No prepayment penalties

- No punitive late fees

- Unmatched customer service

Flexible Spending Account - FSA

It helps to pay for unreimbursed out-of-pocket medical expenses while reducing your taxable income. You do not pay taxes on this money, so it is additional money in your pocket, less to Uncle Sam.

Health Saving Account - HSA

A health savings account is a tax-advantaged medical savings account available to taxpayers in the United States who are enrolled in a high-deductible health plan. The funds contributed to an account are not subject to federal income tax at the time of deposit.

A debit card is issued through the plan and may be used at the point of sale for any medical expense and doctor written prescriptions. Ask your employer if they offer HSA through your employee benefits. Otherwise, most major financial institutions can set up a personal HSA for you.

Please contact our office to schedule your appointment.